Introduction

India’s taxation system, particularly GST (Goods and Services Tax), plays a critical role in business compliance. Managing GST manually can be complex, time-consuming, and prone to errors. Odoo 17 simplifies GST configuration, tax management, invoicing, and reporting, making accounting more efficient for businesses in India.

For businesses looking for a seamless ERP solution, partnering with an Odoo Implementation Company in Kolkata, India can help set up and optimize GST management efficiently.

In this guide, we will walk you through the step-by-step process of configuring and managing GST in Odoo 17, ensuring that your business stays compliant with Indian tax regulations.

Step 1: Enabling GST in Odoo 17

To begin using GST in Odoo, follow these steps:

Navigate to Accounting Module

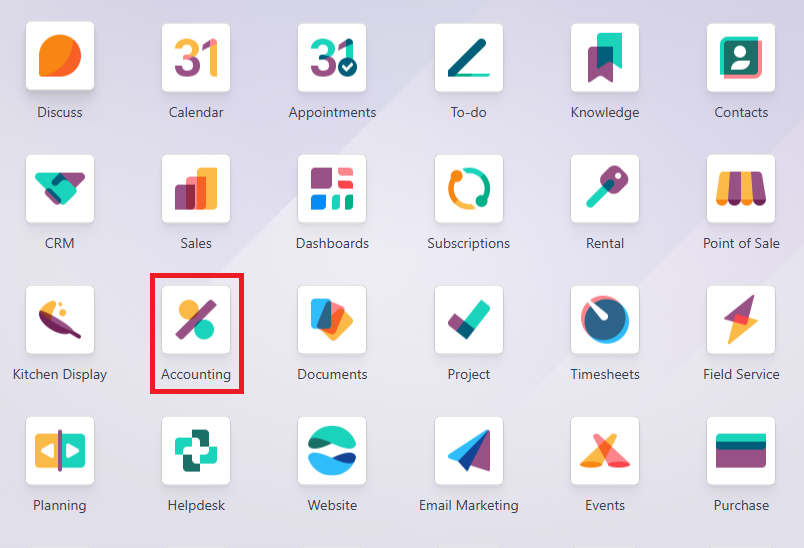

- Go to Apps → Install the Accounting Module (if not already installed).

Enable GST

- Go to Accounting → Configuration → Settings.

- Under the Taxes section, enable GST.

- Select your company’s GSTIN (GST Identification Number).

- Save the settings.

This enables GST across your Odoo system, ensuring tax compliance for your transactions.

Step 2: Setting Up GST Tax Rates

GST in India has multiple tax slabs (0%, 5%, 12%, 18%, 28%). To configure them in Odoo:

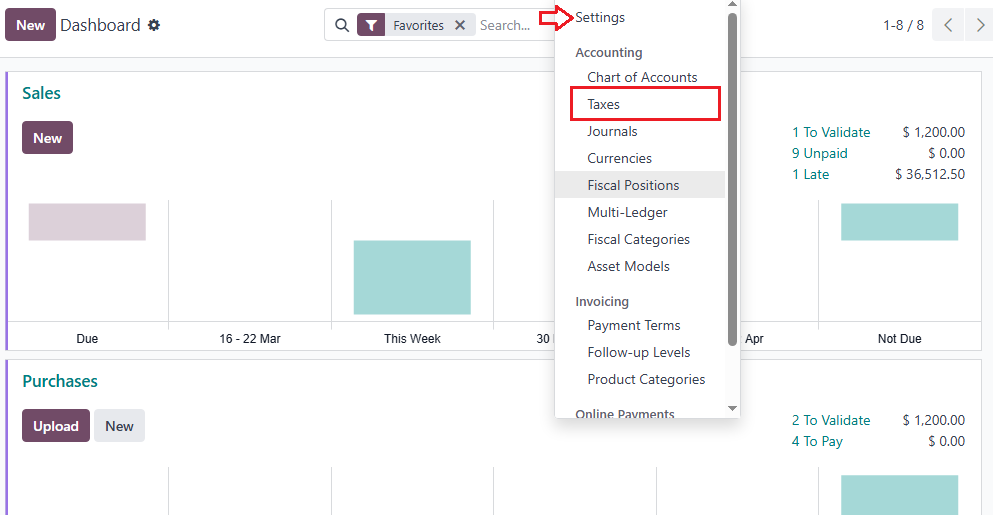

Go to Accounting → Configuration → Taxes.

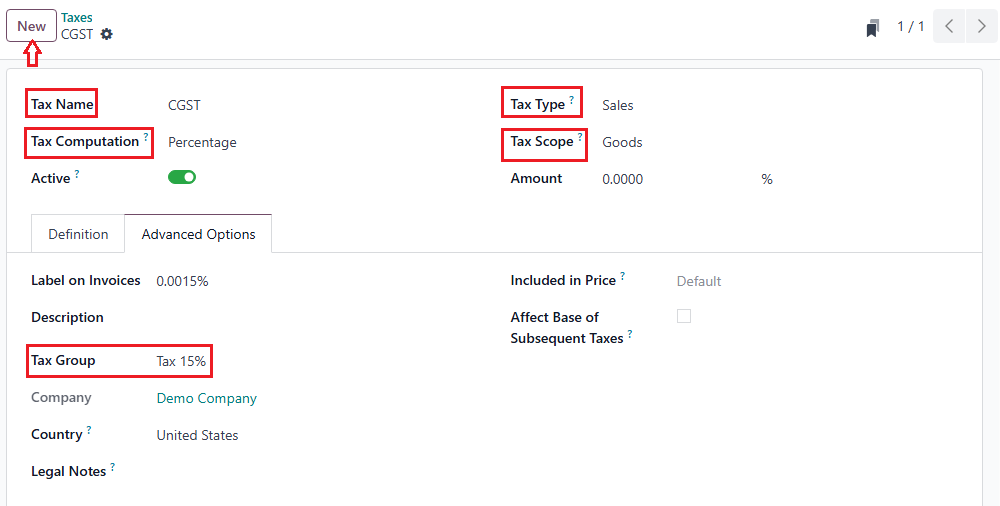

Click Create and define:

- Tax Name: CGST, SGST, IGST, or Composite Tax.

- Tax Type: Sales or Purchase.

- Tax Scope: Goods or Services.

- Tax Rate: Enter the appropriate percentage.

- Save the configured tax.

- Repeat this process to create tax rates for CGST, SGST, and IGST.

Odoo automatically applies the correct tax type based on customer and supplier locations.

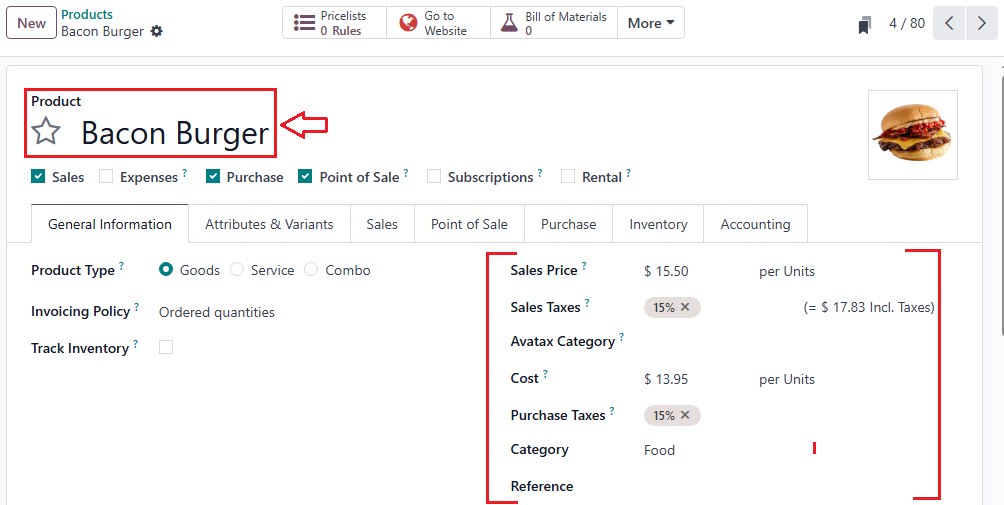

Step 3: Configuring GST for Products

Each product in your inventory must be assigned the correct GST rate.

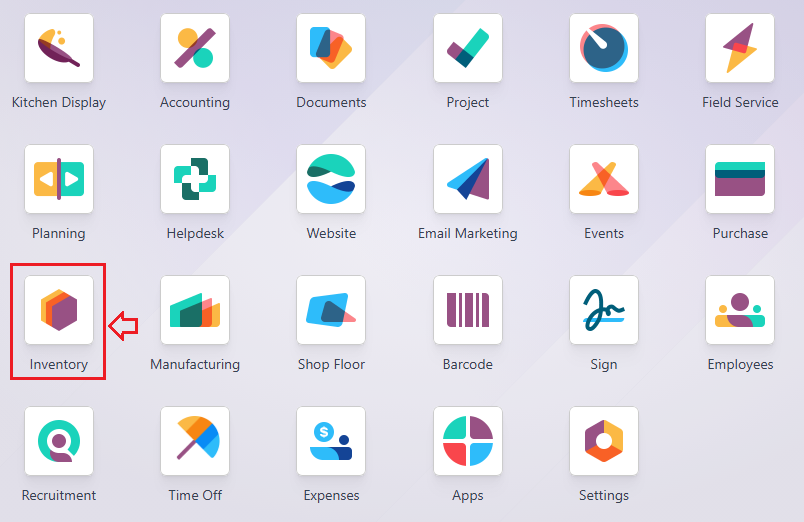

Go to Inventory → Products → Select a Product.

Under the Accounting Tab, set:

- Customer Tax: GST applicable for sales.

- Vendor Tax: GST applicable for purchases.

- Save the settings.

This ensures that GST is automatically applied to products during invoicing.

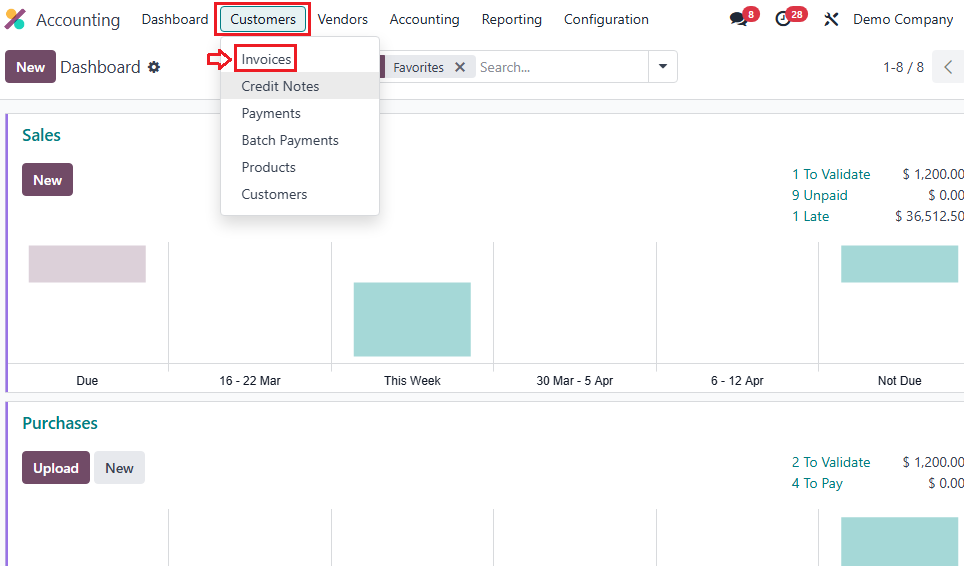

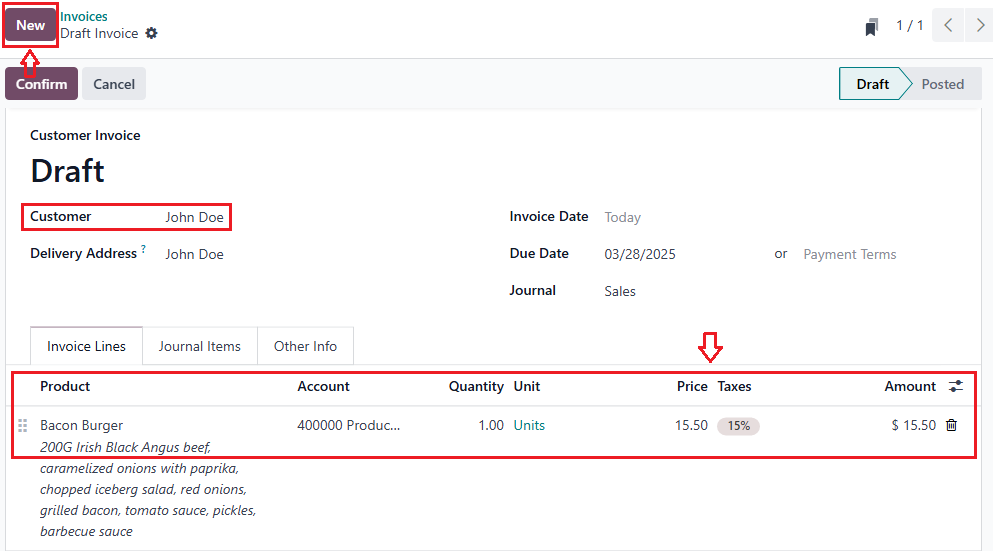

Step 4: Creating GST-Compliant Invoices

Odoo 17 automates GST calculations in invoices. To create a GST invoice:

- Go to Accounting → Customers → Invoices → Create.

- Add the customer details.

- Select the GST-compliant product.

- Odoo auto-calculates CGST, SGST, or IGST based on the customer’s location.

- Validate the invoice and send it.

GST invoices generated in Odoo include all mandatory details like GSTIN, HSN Code, tax breakup, and total tax amount.

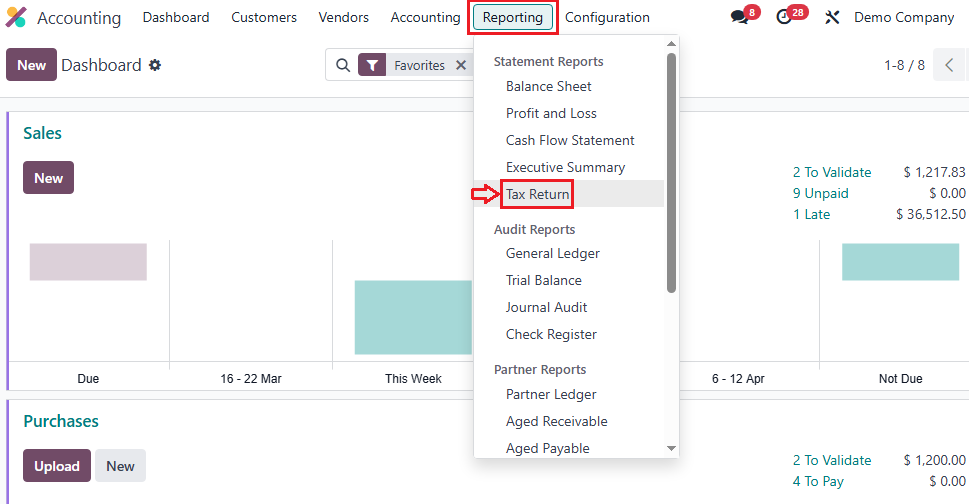

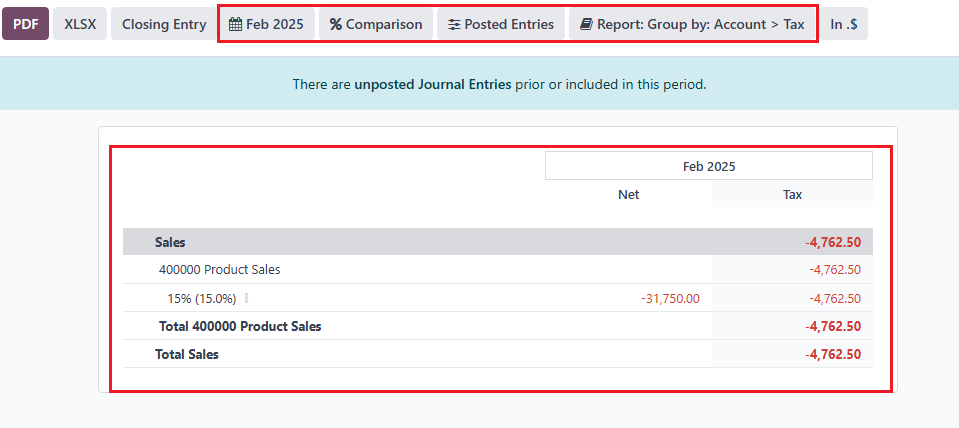

Step 5: GST Reports & Compliance

Odoo 17 provides ready-made GST reports that simplify tax filing. To generate GST reports:

- Go to Accounting → Reporting → Tax Report.

- Select the GST Period (monthly or quarterly).

- Download the GSTR-1, GSTR-2, or GSTR-3B report.

- Cross-check details and file the return.

- Odoo helps businesses stay compliant with Indian tax laws without manual calculations.

For businesses needing advanced ERP customization, working with an Odoo Development Company ensures tailored tax solutions for seamless operations.

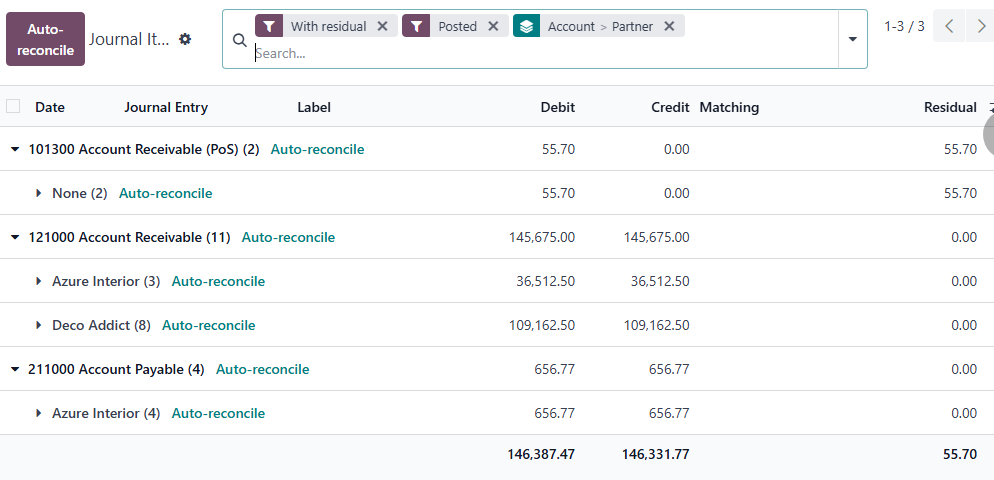

Step 6: GST Reconciliation in Odoo

GST reconciliation ensures that your ITC (Input Tax Credit) claims match supplier tax filings.

- Go to Accounting → Reconciliation.

- Match purchase invoices with GSTR-2A data.

- Identify mismatches and take corrective actions.

This prevents errors in GST filings and avoids penalties from tax authorities.

Why Use Odoo 17 for Indian GST Accounting?

- Automated GST Calculation – No manual tax computation required.

- Seamless GST Compliance – Easy GSTR-1, GSTR-3B reporting.

- GSTIN Validation – Ensures correct tax application based on location.

- Customizable Tax Structure – Adapts to business needs.

- Real-time GST Filing Support – Simplifies tax return submission.

By leveraging Odoo Integration Services, businesses can customize GST accounting as per their specific industry requirements.

Conclusion

Managing Indian Accounting GST in Odoo 17 is now easier than ever. By following the steps outlined above, businesses can automate GST calculations, generate compliant invoices, and ensure smooth tax filing.

For long-term efficiency and compliance, ongoing support from an Odoo Support Services provider can help businesses adapt to changing tax regulations effortlessly.

Looking for expert assistance in configuring Odoo GST? Contact Primacy Infotech today for a smooth Odoo GST implementation experience.

Ready to Transform Your GST Accounting Process?

Book a Free Consultation with Primacy Infotech to learn how Odoo can streamline your business finances today!

📞Call: +919088015866 / +919088015865 | 📧 Email: info@primacyinfotech.com | 🌐 Visit: www.primacyinfotech.com