Introduction

Tax compliance is a crucial aspect of running a business, and managing taxation effectively ensures smooth financial operations. Odoo 18, the latest version of the comprehensive ERP solution, provides a powerful taxation module that simplifies tax calculations, reporting, and compliance for businesses across industries. Whether you're dealing with GST, VAT, corporate taxes, or multi-country taxation, Odoo 18 automates the process, ensuring accuracy and efficiency.

Businesses in India, the USA, the UK, and across the world must comply with varying tax regulations. Odoo 18’s tax management module is designed to cater to different taxation laws, ensuring businesses stay compliant while automating tax workflows. From automated GST returns filing to multi-currency tax handling, Odoo 18 makes tax management effortless.

This blog will explore how Odoo 18 simplifies taxation, covering features, configurations, and best practices to help businesses stay compliant with tax regulations while improving financial efficiency.

1. Key Taxation Features in Odoo 18

Odoo 18’s Accounting and Taxation module is designed to handle various types of taxes efficiently. Here are some key features:

a) Automated Tax Calculation

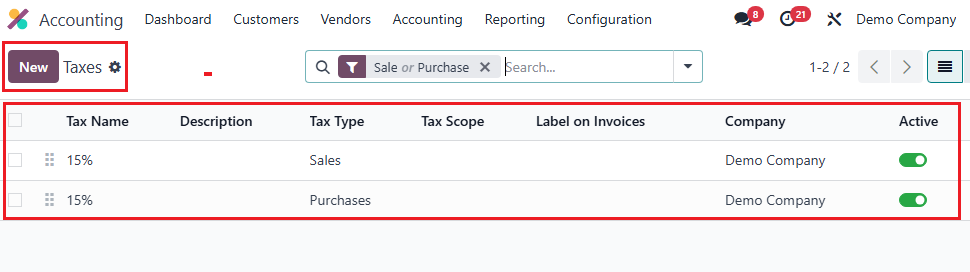

- Navigate to Accounting Module → Taxes

- Set up tax-inclusive or tax-exclusive pricing

- Define multiple tax rates as per regulations

- Supports tax computation for different product categories

- Manages different tax rates for B2B and B2C transactions

b) GST, VAT & Multi-Country Tax Compliance

- Preconfigured tax rules for different regions

- Supports GST, VAT, Sales Tax, and Service Tax

- Integration with government tax portals for e-filing

- Handles multi-state and multi-country taxation

- Supports HSN & SAC code mapping for GST compliance

c) Tax Reports & Audits

- Generate automated tax reports in real-time

- View audit logs and transaction history

- Export reports in CSV, PDF, or Excel for easy submission

- Automated reconciliation of tax payments

- Track tax credits and refunds efficiently

d) Reverse Charge & Withholding Tax

- Enable reverse charge for international transactions

- Configure withholding tax on invoices and payments

- Set up tax exemption rules for specific cases

- Automatically adjust tax rates based on customer location

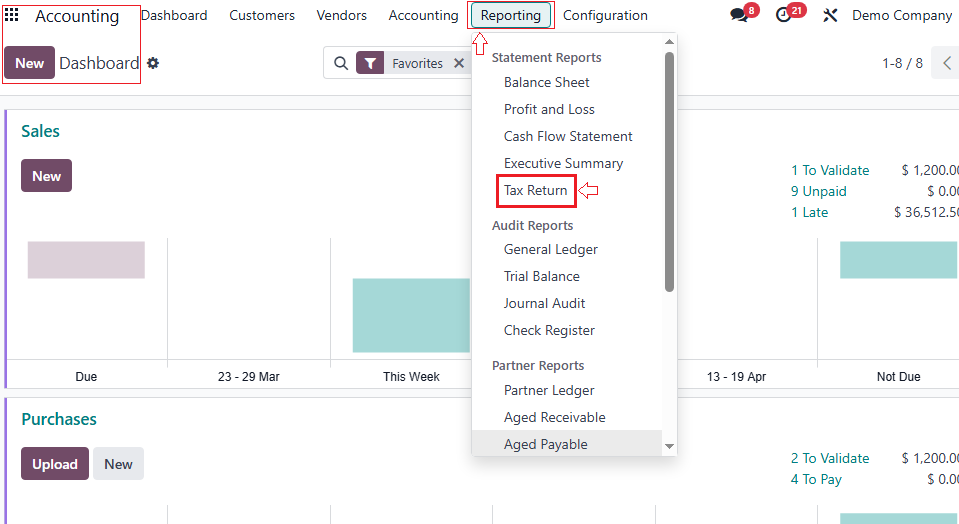

2. How to Configure Taxes in Odoo

Setting up taxation in Odoo 18 is simple and can be customized based on business needs

Step 1: Enable Taxation in Odoo 18

- Go to Accounting Module

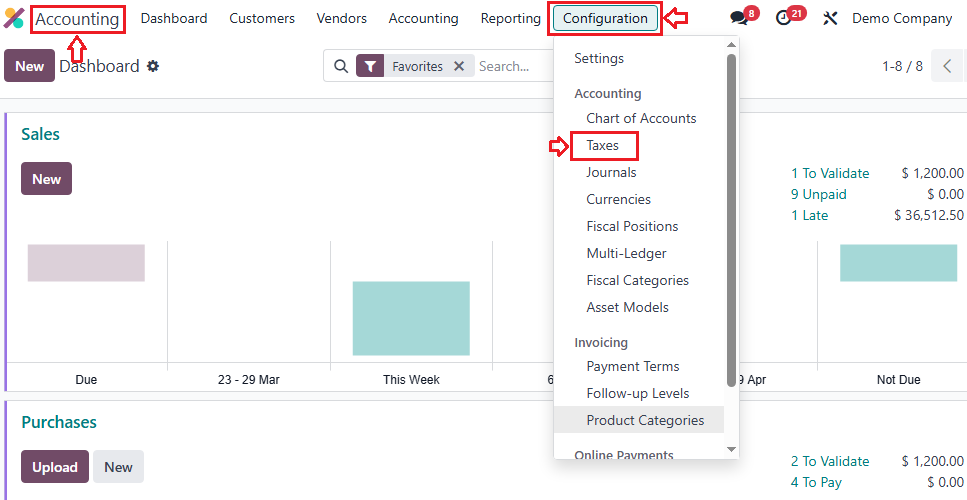

- Navigate to Configuration → Taxes

- Click on 'Create' to add a new tax

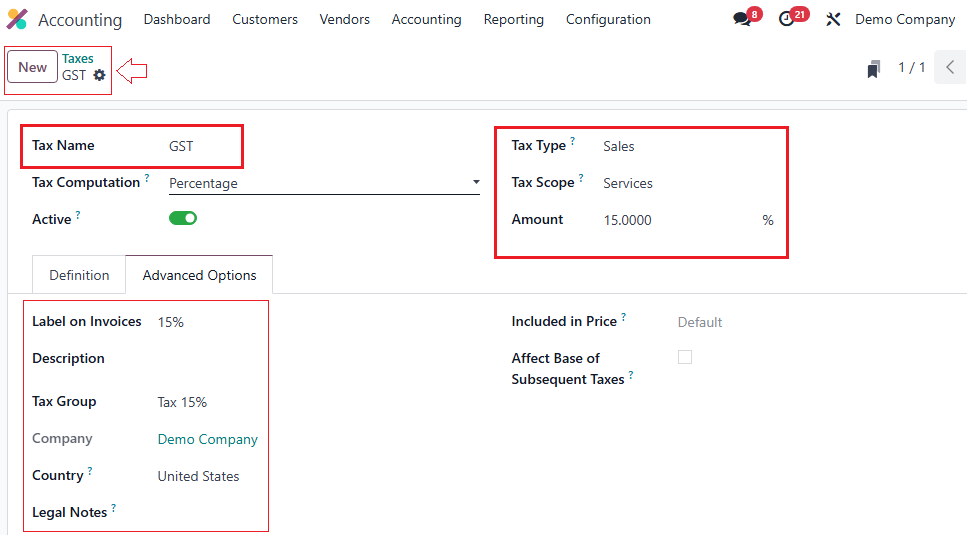

- Set tax name, type (GST, VAT, etc.), and computation method

- Save and apply to relevant products

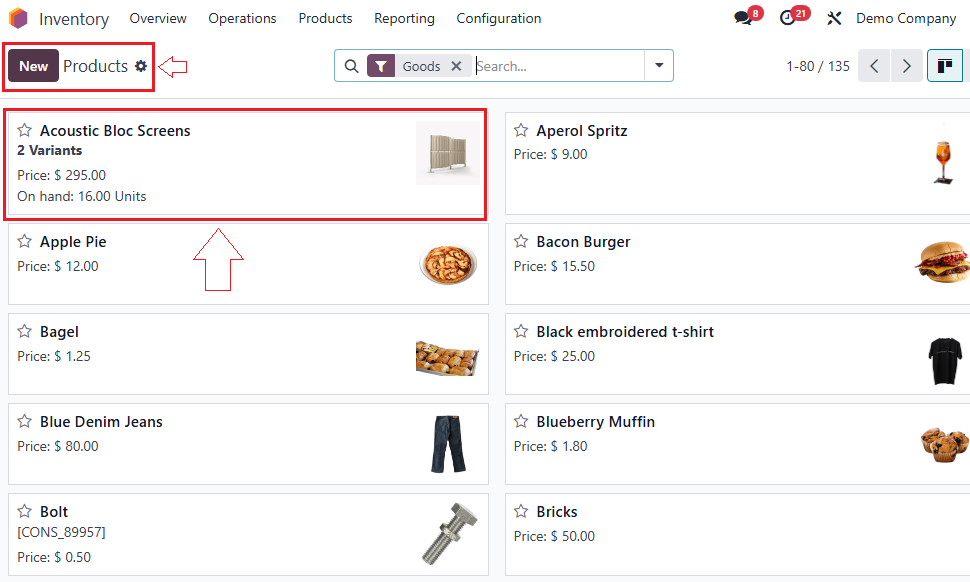

Step 2: Assign Tax to Products

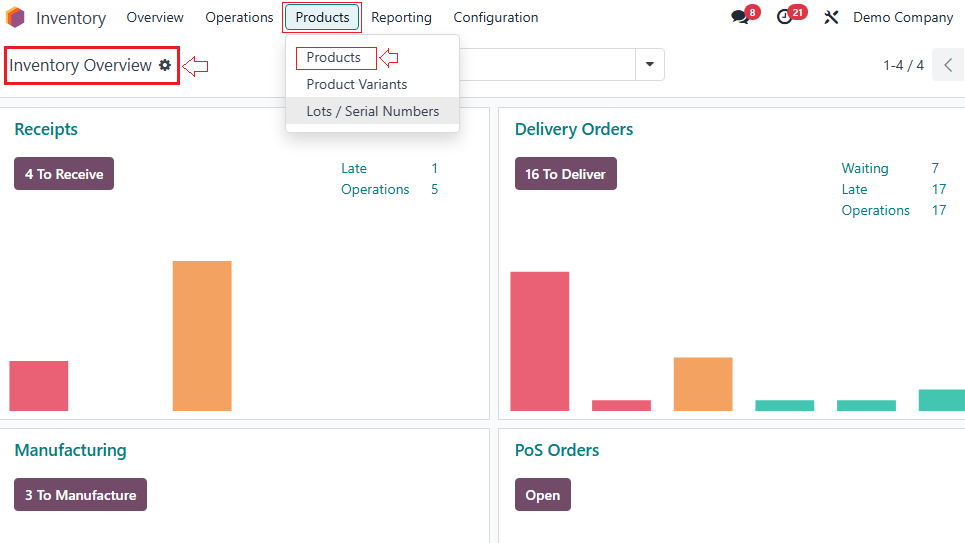

- Open Inventory → Products

- Select the product and navigate to the Sales/Purchase tab

- Under the Tax section, choose the appropriate tax

- Save changes

Step 3: Setting Up GST in Odoo 18

- Navigate to Accounting → Taxes → GST Configuration

- Enable CGST, SGST, IGST based on business location

- Define HSN/SAC codes for tax compliance

- Set up GST rates for different products and services

- Configure automatic GST invoice generation

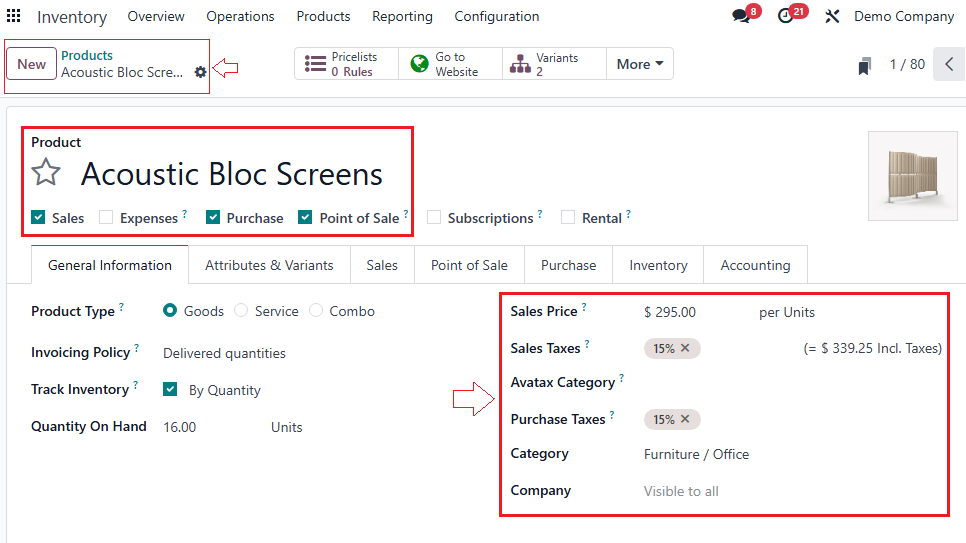

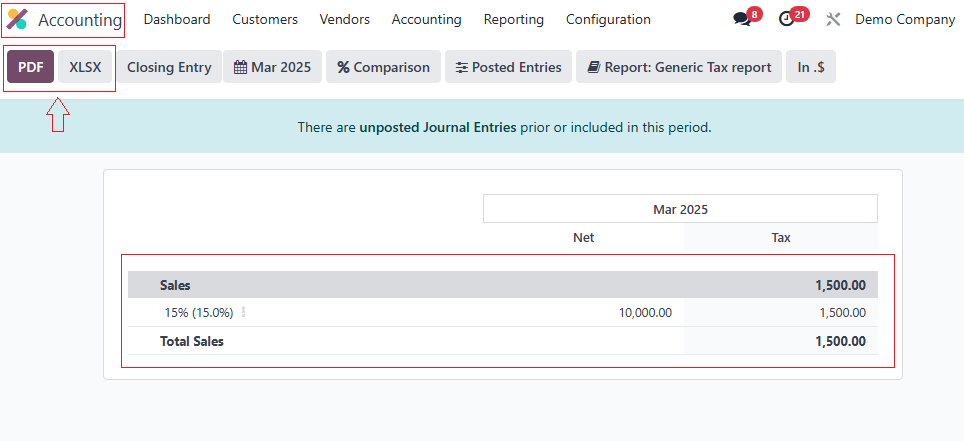

Step 4: Generating Tax Reports in Odoo 18

- Go to Accounting → Reporting

- Select Tax Report

- Choose the date range and generate the report

- Export the report in desired format (CSV, PDF, XLSX)

- Integrate with tax filing software for easy submission

3. Benefits of Using Odoo for Taxation

1. Accuracy & Compliance

- Automated tax calculations reduce errors

- Ensures compliance with local and international tax laws

- Auto-applies correct tax rules based on transaction type

- Reduces tax penalties and compliance risks

2. Saves Time & Reduces Manual Work

- Eliminates manual tax calculations

- Automates tax reports, returns filing, and reconciliations

- Allows bulk tax configuration for multiple products

3. Scalability for Businesses

- Supports small, medium, and enterprise businesses

- Handles taxation for multiple branches and locations

- Supports e-commerce taxation and multi-channel selling

4. Integration with Other Modules

- Seamlessly works with Sales, Purchase, and Inventory

- Manages taxation alongside accounting functions

- Compatible with third-party tax software and GST e-invoicing

4. Common Challenges & How Odoo Solves Them

| Challenges | How Odoo 18 Helps |

|---|---|

| Complex tax calculations | Automates tax rates & applies correct tax rules |

| Multi-country compliance | Preconfigured tax settings for different countries |

| Manual tax report generation | Generates tax reports with real-time insights |

| Filing errors | Reduces mistakes with system-driven calculations |

| Withholding tax handling | Applies correct tax deduction for compliance |

| E-invoicing compliance | Generates GST-compliant e-invoices automatically |

| GST reconciliation issues | Automates matching of purchase & sales GST entries |

Conclusion

Managing taxation manually can be time-consuming and error-prone, but Odoo 18 simplifies the entire process with its automated tax calculations, real-time tax reports, and seamless integrations. Whether you’re dealing with GST, VAT, or corporate tax, Odoo 18 ensures your business stays compliant while reducing manual effort.

💡 Looking for expert assistance in configuring taxation in Odoo 18? Primacy Infotech provides expert Odoo Implementation, Odoo Development, and Odoo Support Services to help your business manage tax compliance efficiently.

📞 Call: +919088015866 / +919088015865 | 📧 Email: info@primacyinfotech.com | 🌐 Visit: www.primacyinfotech.com